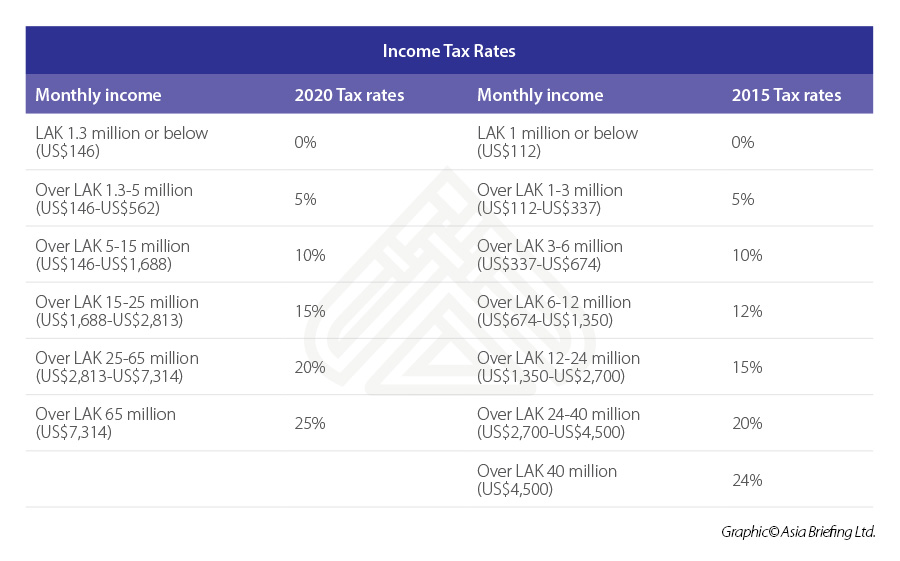

Personal Tax Rates 2015 Malaysia

Malaysia personal income tax rates 2013.

Personal tax rates 2015 malaysia. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. No other taxes are imposed on income from petroleum operations.

Corporate tax rates in malaysia. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Malaysia personal income tax rate. Pay your tax now or you will be barred from travelling oversea.

The rates are final and applied only if the payment is made at once or in two years at the maximum if the payment is made in sequence. Rm9 000 in individual tax relief rm4 620 in epf contribution tax relief 11 of rm42 000 which is rm4 620 putting both taxable income and tax reliefs together we get. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Other income is taxed at a rate of 26 for 2014 and 25 for 2015.

2 501 5 000. Home income tax income tax rates. The corporate tax rate is 25. Information on malaysian income tax rates menu.

Chargeable income calculations rm rate tax rm 0 2500. Special personal tax relief rm2 000. Income tax rates 2020 malaysia. Non residents are subject to withholding taxes on certain types of income.

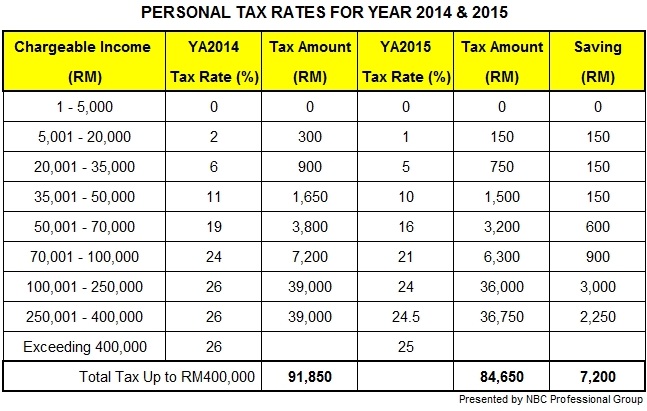

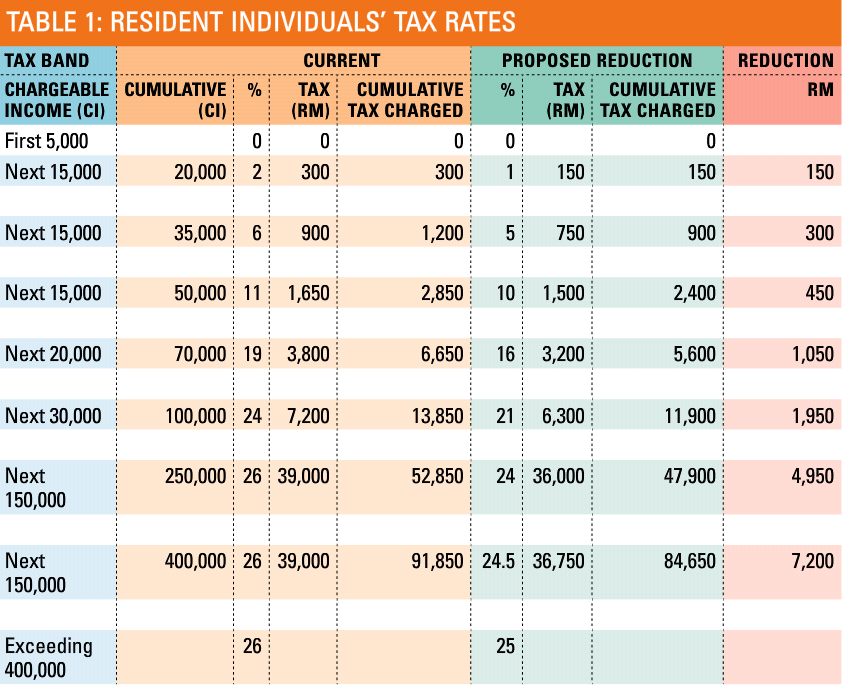

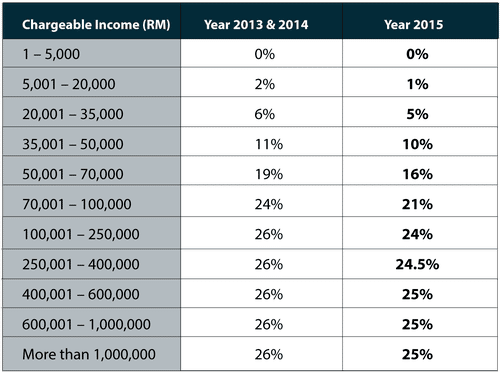

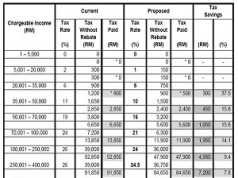

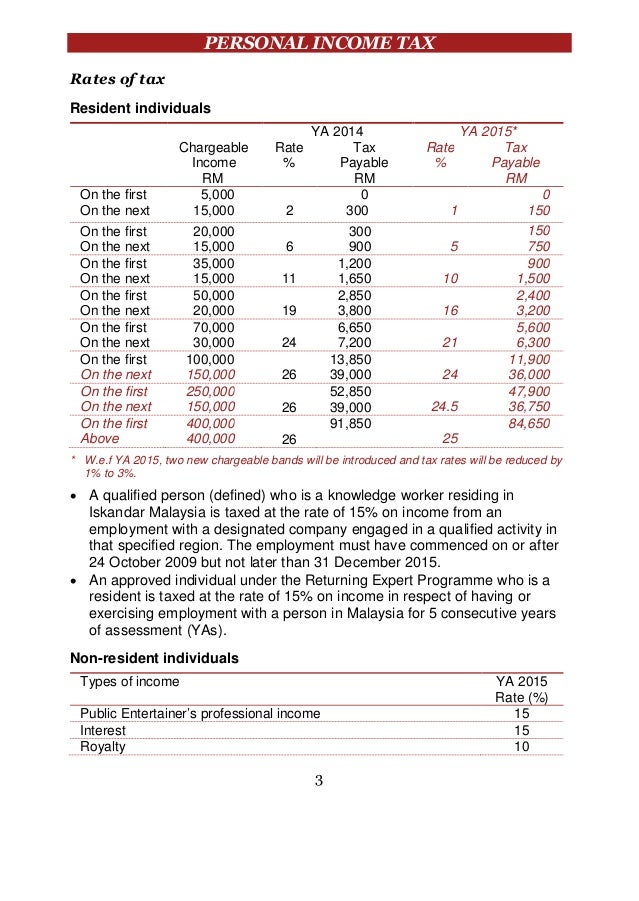

As it was announced in budget 2014 proposed in the latest budget 2015 individuals income tax rates will be reduced by 1 to 3 with effective from the year of assessment 2015. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. There are no other local state or provincial. On the first 2 500.

For payments for year three onwards the ordinary individual tax rates apply. How to do e filing for individual income tax return. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. There are no local taxes on individual income in indonesia.