Personal Income Tax Rate 2019 Malaysia

Calculations rm rate tax rm 0 5 000.

Personal income tax rate 2019 malaysia. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. What is a tax exemption. W e f 28 december 2018 services liable to tax refers to any advice assistance or services rendered in malaysia and is not only limited to services which are of technical or management in nature. Understanding tax rates and chargeable income.

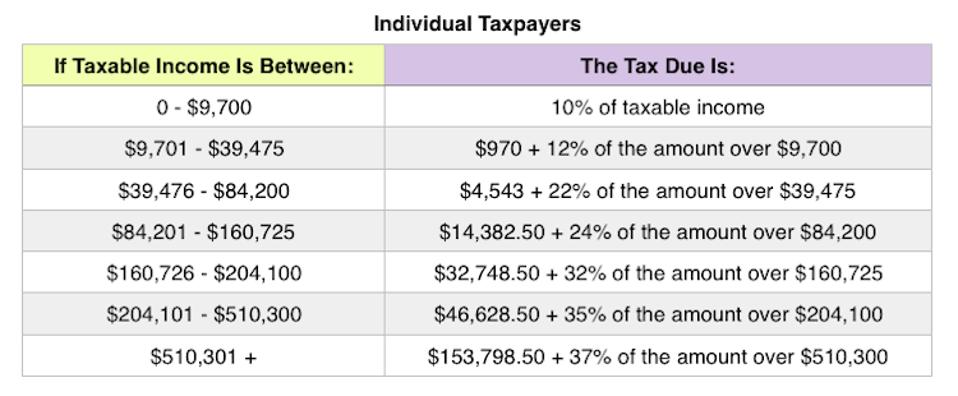

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Previously the rate was 28 in ya 2019. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. Here are the income tax rates for personal income tax in malaysia for ya 2019.

Green technology educational services. On the first 2 500. On the first 5 000 next 15 000. What is chargeable income.

Understanding tax rates and chargeable income. You don t have to pay taxes in malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside malaysia. What is tax rebate. Here are the tax rates for personal income tax in malaysia for ya 2018.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.