Paragraph 127 3 B

B in a registration license application or report required by 38 or 39 of the arms export control act 22 u s c.

Paragraph 127 3 b. Section 127 is to be covered. Apr 4 2018 01 40 pm updated 3y ago. 1 notwithstanding any other provision of this act but subject to section 127a any income specified in part i of schedule 6 shall subject to this section be exempt from tax. In pn 2 2018 the irb clarifies that the scope of exemption granted under.

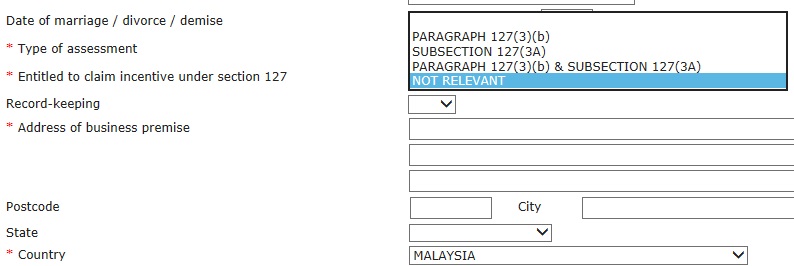

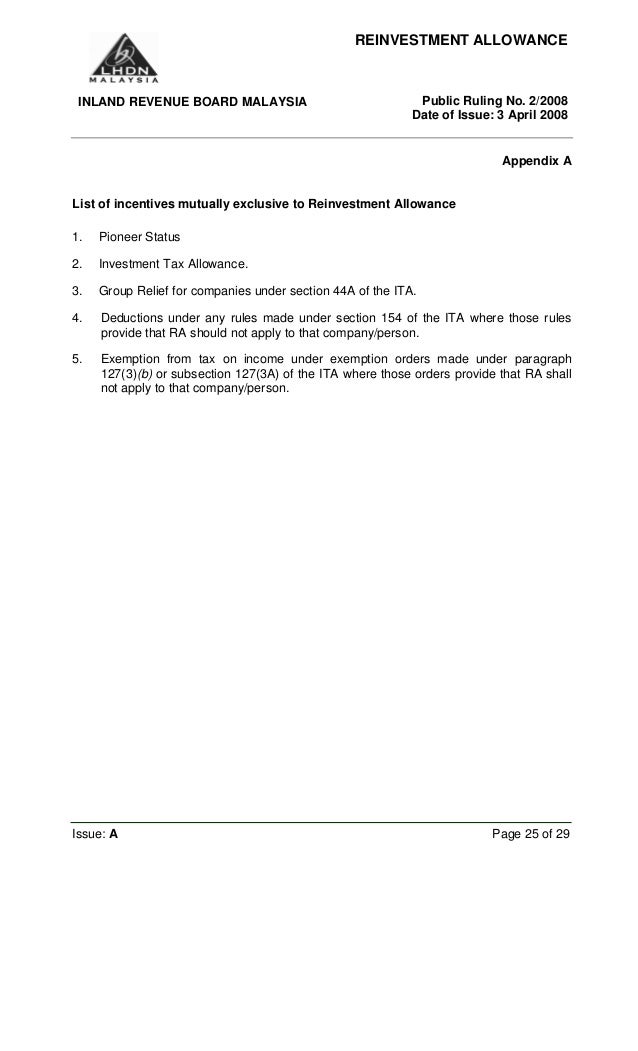

1 paragraph 127 3 b of ita 1967 exemption given by the minister of finance to any class of persons from complying with any provision of the income tax act 1967 either. For purposes of this section an educational assistance program is a separate written plan of an employer for the exclusive benefit of his employees to provide such employees with educational assistance. Section 127 1 income exempted under schedule 6 of the ita section 127 3 b exemptions made under gazette orders section 127 3a exemptions given directly by the minister of finance usually via a letter to the taxpayer. Paragraph subsection paragraph subsection not relevant.

Paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter. A is the total of all amounts each of which is a qualified expenditure incurred by the taxpayer in the year b is the total of all amounts each of which is an amount determined under paragraph 127 13 e for the year in respect of the taxpayer and in respect of which the taxpayer files with the minister a prescribed form containing prescribed information by the day that is. 1151 g 3 substituted for purposes of this paragraph there may be excluded from consideration employees who may be excluded from consideration under section 89 h for for purposes of this paragraph there shall be excluded from consideration employees not included in the program who are included in a unit of employees covered by an agreement. 2778 and 2779 or by any rule or regulation issued under either section makes any untrue statement of a material fact or omits a material fact required to be stated therein or necessary to make the statements therein not.

History subsection 127 1 is amended by act 608 of 2000 s18 by inserting after the word act the. What is claim incentive under section 127. Junior member 33 posts joined. C 3 the total of all amounts each of which is an amount deductible in computing the individual s income for the year in respect of a property for which an identification number is required to be or has been obtained under section 237 1 other than an amount to which any of paragraphs 127 52 1 b to 127 52 1 c 2 applies were nil.

Show posts by this member only post 1. Claim incentive under section 127 which one to choose. Exemptions from tax general.