Malaysian Tax Revenue Statistics

Chapter 3 table 3 15 tax revenues of subsectors of general government as of total tax revenue chapter 3 table 3 2 total tax revenue in us dollars at market exchange rate chapter 3 tables 3 7 to 3 14 taxes as of gdp and as of total tax revenue.

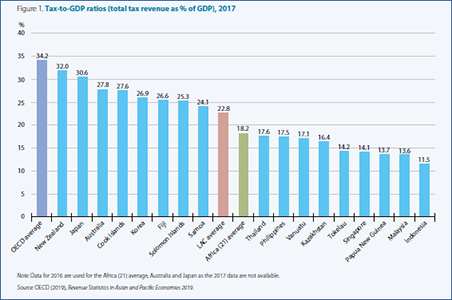

Malaysian tax revenue statistics. The second highest share of tax revenues in 2018 was derived from personal income tax 18 0. Indirect tax revenue in malaysia from 2012 to 2018 in billion malaysian ringgit chart. Revenue statistics in asian and pacific economies. Malaysia s tax to gdp ratio was 12 5 in 2018 below the oecd average 34 3 by 21 8 percentage points and also below the lac and africa 26 averages 23 1 and 17 2 respectively.

Key findings for malaysia. Chapter 3 table 3 15 tax revenues of subsectors of general government as of total tax revenue chapter 3 table 3 2 total tax revenue in us dollars at market exchange rate chapter 3 tables 3 7 to 3 14 taxes as of gdp and as of total tax revenue. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes. Accessed september 05 2020.

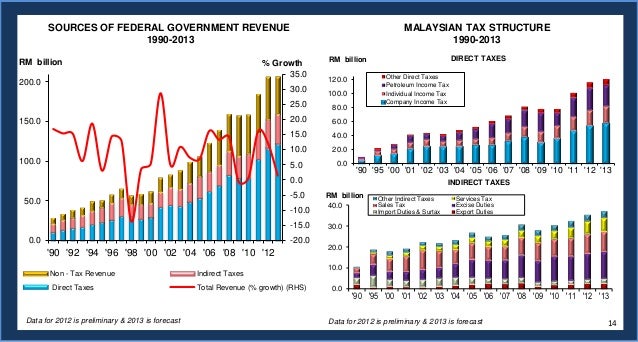

In 2012 the sin tax revenue from the abovementioned products was slightly under 4 7 billion malaysian ringgit. This statistic shows the tax revenue received in malaysia from 2000 to 2016. 3 17 44 3 184 14 10 124 tax structure in malaysia 20 17 taxes on goods. The highest share of tax revenues in malaysia in 2018 was derived from corporate income tax 47 9.

In 2017 the sin tax revenue from these products increased to approximately 5 86.