Malaysia Personal Income Tax Rate

What is chargeable income.

Malaysia personal income tax rate. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia.

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. The income tax rates and personal allowances in malaysia are updated annually with new tax tables published for resident and non resident taxpayers. Malaysia personal income tax guide for 2020.

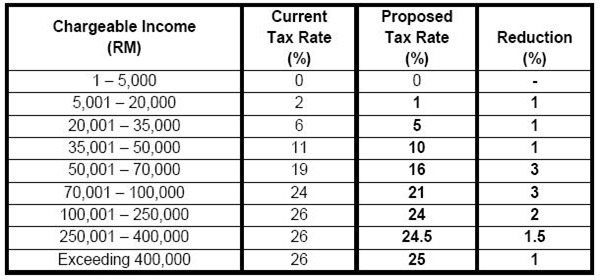

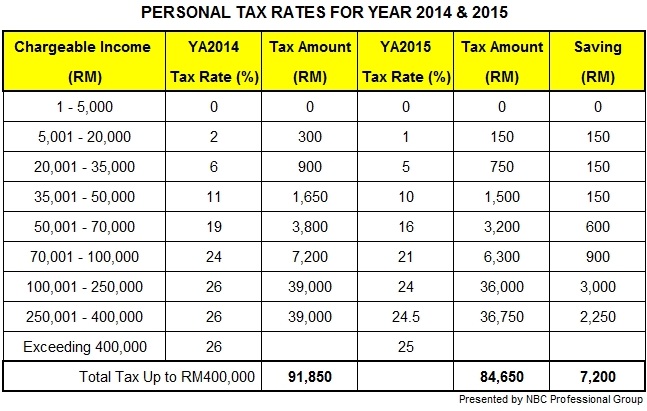

Personal income tax rates. The following rates are applicable to resident individual taxpayers for ya 2020. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. The income tax act of 1967 structures personal income taxation in malaysia while the government s annual budget can change the rates and variables for an individual s taxation.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Taxable income myr tax on column 1 myr tax on excess over. What is tax rebate. Understanding tax rates and chargeable income.

Here are the income tax rates for personal income tax in malaysia for ya 2019. No other taxes are imposed on income from petroleum operations. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. There are no other local state or provincial.

What is a tax exemption. Malaysia personal income tax rate. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar.

As expatriates may fall into either tax category it is important to understand malaysia s basic tax structure.